Wear a Mask

I’m often asked, “What can I do to increase my portfolio returns?” It’s normally the start of a conversation about a specific stock they’re considering or what allocation is right for them. And, typically, I can provide a few helpful tips. But, this is the first (and hopefully last) time that the answer is: “wear a mask.”

The playbook we outlined back in March hasn’t changed — the critical, first step for economic recovery is containing the virus and preventing unnecessary loss of life. As a country, we implemented drastic measures to give ourselves time to prepare. Going forward, it’s unlikely we’ll be willing to shutdown again due to the harsh economic consequences. Instead, it’s likely we’ll try to operate in a “new normal” with the precautions we’ve put into place.

If there’s a chance masks slow the virus, we should be willing to try anything that keeps businesses open. I believe we’ll ultimately do whatever it takes to win, but history suggests we may take a circuitous path. Winston Churchill once famously observed this about Americans:

“Americans will always do the right thing, only after they’ve tried everything else.”

This past quarter was extremely positive from a financial market standpoint. So positive, in fact, that many believe there’s a disconnect between the stock market and the economy. This isn’t new — prices react to expectations about the future, not just what’s happening today.

This chart shows the ten best and worst performance quarters in the history of the S&P 500 index. You’ll notice the past two quarters are on both lists! It’s a reflection of the unique nature of this crisis. It was never going to follow the snowball-rolling-down-a-hill path of most recessions. Recessions aren’t typically caused by a virus.

Containing the Virus

If we have any hope of sustaining the recent market rally, we must make progress in the war against the virus. This could happen in a number of ways: changes in behavior(s) that slow transmission (masks, social distancing, etc.), a mutation in the virus itself, more effective treatment for those that require hospitalization, or an effective vaccine. Any of these would give the market more certainty about the economy’s ability to recover in a timely manner.

Unfortunately, our progress containing the virus is regressing:

This is bad news for the economy because people slow consumption if they don’t feel safe (regardless of whether the business is open or not)! New digital channels are helping businesses tread water, but it may not be enough. If we can’t figure out a way to contain the virus without shutdowns, expectations about the future of the economy will fall and drag the stock market with it.

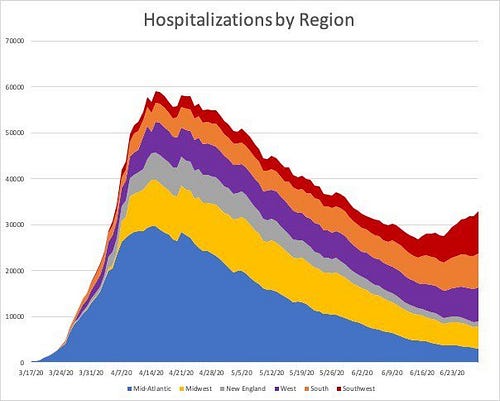

The interesting part of this crisis is that while the entire world has been laser-focused on this threat since March, everyone has experienced it differently based on where they live.

The majority of early cases in the U.S. were really a Mid-Atlantic (New York as the poster child) phenomenon. That region has largely recovered, but now we’re seeing spiking cases in the Southwest, South, and West.

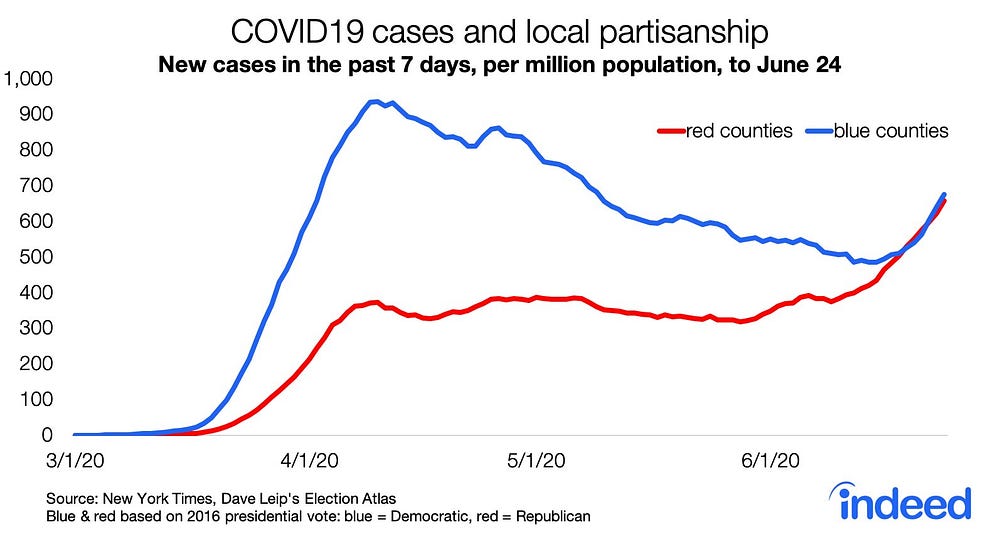

Similarly, the initial spread of the virus impacted Republican and Democratic regions differently. This may explain why the virus itself has become such a polarizing political issue. If your community wasn’t impacted initially, it’s human nature to be skeptical. But, that has changed!

“Red” counties initially experienced mild infections relative to “blue” counties until the shutdowns ended. Now, everyone is experiencing similar infection rates. For the first time in this crisis, regardless of where you live or what you believe, we’re all in this together.

Backstopping the Economy

Like many countries around the world, we were caught flat-footed and responded by putting the economy into a regulation-induced coma designed to save human lives. We were bound to set records simply because of the dramatic nature of what occurred in March.

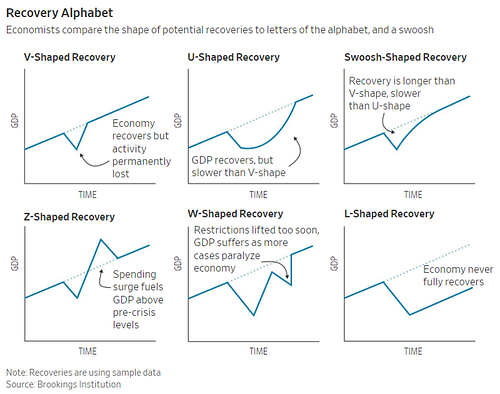

So far at least, we’ve seen signs of a dramatic “V-shaped” recovery. But, it’s critical that the our recovery is sustained and that businesses aren’t forced to close again. If they do, the recovery may look more like some of the less desirable outcomes in this graphic. Falling short of our country’s full economic output would mean widespread pain for businesses and individuals alike.

What we predicted back in early April has played out: some of the worst economic numbers you’ve ever seen followed by shocking, positive swings in the other direction.

Only hindsight will tell us if the benefits of shutdown ultimately outweigh the economic costs. But, it’s still too early to tell. We’ve yet to see all the businesses that will fail and jobs that may be permanently impacted.

It’s easy to second-guess decisions after-the-fact. But, when you’re dealing with unknowns, the optimal decision is often a diversified approach. This is the key concept of portfolio theory and why we choose multiple investments even though there will be only one top performer. The problem, of course, is that it’s impossible to know beforehand — it’s only obvious in hindsight.

And, just like investing, an extreme approach in either direction is incredibly risky if you’re wrong. Shutting the economy looks foolish if the virus doesn’t spread as fast or kill as many people as originally believed. On the other hand, a government that doesn’t impose shutdowns risks massive loss of life if the virus proves to be more deadly and contagious. It’s a delicate balance between economic disaster and the loss of human life. These are tough decisions, and there are no easy answers.

History Rhymes

A bizarre aspect of this crisis is the eerie similarity to the 1918 pandemic. And, our brazen disregard for the lessons learned. It followed a similar path with respect to timing and seasonality: an initial wave of infections in the spring, a mild summer, followed by surging cases in the fall.

Similar to today, many rebelled against regulations designed to save lives. The Anti-Mask League of San Francisco is the most famous from this time period. Nearly a century old, the spirit of this group is alive and well today. So much so, that it’s hard to tell the difference between today’s headlines and those from 1918. We can’t expect our outcome will be any different unless we learn from their mistakes.

So, mask up! Pray for a vaccine. And, be nice to each other. If savings lives isn’t enough, do it for your portfolio! 😀

Commas, through our parent Truepoint, Inc. is a fee-only Registered Investment Adviser (RIA). Registration as an adviser does not connote a specific level of skill or training. More detail, including forms ADV Part 2A & Form CRS filed with the SEC, can be found at commas.devphase.io. Neither the information nor any opinion expressed, is to be construed as personalized investment, tax, or legal advice. The accuracy and completeness of information presented from third-party sources cannot be guaranteed. Commas is a wholly-owned subsidiary of Truepoint Inc.

Commas is a wholly-owned subsidiary of Truepoint Inc., a fee-only Registered Investment Adviser (RIA). Registration as an adviser does not connote a specific level of skill or training nor an endorsement by the SEC. More detail, including forms ADV Part 2A and Form CRS filed with the SEC, can be found at www.usecommas.com. Neither the information, nor any opinion expressed, is to be construed as personalized investment, tax or legal advice. The accuracy and completeness of information presented from third-party sources cannot be guaranteed.